Fast Credit Repair in Laredo, TX

Repair Fast Credit get access to the best Credit Repair in Laredo, Texas, contact professionals available in today.

About Repair Fast Credit

Reliable Credit Repair

Here at Repair Fast Credit, we have professionals whose sole mission is to help consumers like you improve your credit reports and ratings. Late payments, foreclosures, tax liens, and student loans are just some of the many financial problems we can help you with.

- Credit Repair Consultation

- Credit Monitoring

- Credit Building

- Credit Experts

- Credit Repair Company

- Credit Score

About Repair Fast Credit

See How Repair Fast Credit Can Work For You!

Look Up Your Credit Report

If you need assistance keeping track of your money, we can monitor your credit score for you.

Raise Your Credit Score

We provide a comprehensive service to raise your credit score.

24/7 Credit Repair Tracking

In real-time, you can track your credit restoration status with our always-accessible online system.

Fix Your Credit Score

We can monitor your credit score and assist you resolve any problems that may arise.

Get Our Special ervices

Our Featured Services

Get Free Consultation

Laredo, TX

USA Information

The United States is a confederation of 50 states that together span a huge region of North America; the territories of Alaska and Hawaii further extend American influence into the Pacific. New York, a worldwide financial and cultural hub, and Washington, DC, the nation’s capital, are both important Atlantic Coast cities. Chicago, a major city in the Midwest, is well-known for its groundbreaking buildings, whereas Hollywood, in Los Angeles, is well-known for its movies.

Credit Repair Laredo, TX - Credit Repair Experts!

Achieving financial freedom brings you a step closer to living the life you desire. But that dream can only become a reality if you have a good credit score. A spotty credit report will lead to higher interest rates and fewer loan options. It can also make it harder to find housing and acquire certain financial services. In some cases, it can even count against you in a job hunt.

You’ll be surprised just how a poor credit history has more consequences than you’d imagine. But all hope is not lost; you can always restore your credit score through credit repair services. That said, if you’re looking for credit repair services in Laredo, TX, you’ve come to the right place. Credit Repair Laredo, TX is hands down one of the best credit repair companies in the area.

We provide people in Laredo, TX, and neighboring cities with affordable lawyer-assisted credit repair services. We have a team of highly qualified lawyers and credit repair experts available to offer a free consultation for your credit repair needs in Laredo, TX. Credit Repair Laredo, TX will assist you with your credit-related concerns, such as inaccurate and negative items on your credit report, late repayments, collection accounts, bankruptcy, and judgments.

One thing about our team, we won’t rest until your rights are fully protected, and we see potent results for even the most severely damaged credit. We thoroughly analyze your debt and credit history and tailor a plan to your specific situation. We all deserve an accurate and fair credit report and score, and credit repair in Laredo, TX, will help you achieve just that. That said, let’s explore some of the services Credit Repair Laredo, TX offers.

Go Home: Click Here

Credit Repair Texas Services

Credit Repair Laredo, TX,offers the following services to help repair your credit and achieve the financial stability you desire.

Credit Score Analysis

Credit score analysis involves several firms evaluating a person’s or company’s credit score to determine their creditworthiness. Credit repair Laredo, TX credit score analysis helps you access, understand, leverage,and defend your credit score all from one place.

Credit Repair

Credit repair Laredo, TX, also assists people in effectively repairing their credit. Our service investigates your credit history, removes any incorrect credit reports,and helps you file disputes with all three credit bureaus. We are committed to offering credit repair services at the most affordable price. On top of that, we offer advice on how you can improve your credit score.

Credit Score Rebuilding

Our credit score rebuilding service helps you establish credit. We’ll discuss various ways in which you can rebuild your credit later in this article. Stay tuned for our detailed step-by-step tutorial. On the other hand, if you’re starting your credit repair journey, you can seek professional help from credit repair Laredo, TX,and we’ll offer tailored solutions to fit your specific needs.

Everything You Need to Know About Your Credit Score

Do you know what your credit score is at the moment? Have requested for a credit score report within the last year? Well, according to research, nearly a quarter of Americans barely check their credit score. The world of credit scores can be confusing for most people,and the fact that there’s lots of false information out there makes it even more complicated.

Sometimes what you think is good for your credit score may depress it and what you think might hurt your credit score is just what you need to improve it.That’s why most people find it easier to just disregard their credit information altogether. But, understanding the intricate details of how your credit score works could help you avoid costly mistakes in the future.

In this section, we’ll discuss everything you should know about your credit score, starting from the importance of a good credit score and why it’s crucial for consumers. Also, we’ll expand on why you should hire your credit repair Laredo, TX to help with your credit score needs. Whether you just graduated high school or you’re trying to rebuild your credit, this will help you position yourself for stellar credit.

What is a Credit Score?

A credit score indicates a consumer’s credit worthiness using a number between 300 and 850. A consumer will have a high credit score depending on how well they appear to potential lenders. This score is usually based on a person’s credit history. That includes their number of open accounts,the total amount of debt history, and their repayment history,among other factors.

Lenders use your credit score to determine your likelihood of making a timely loan repayment after borrowing. While many credit bureaus exist in the US, only Experian, TransUnion, and Equifax have significant national importance. This trio dominates the market and is responsible for collecting, analyzing, and disseminating information about credit-market consumers.

The Fair Isaac Corp., now known as FICO, developed the credit score model financial institutions use today. While there are other credit scoring systems, the FICO Score is the most widely used. Individuals can achieve an excellent credit score by repaying their loans on time and keeping their debt to a minimum.

Why is a Good Credit Score Important?

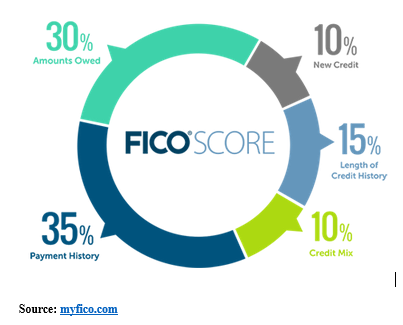

FICO Scores are calculated using various credit data from your credit report. This information is classified into five categories, including;

- Your payment history (35%)– checks if you have missed any loan repayments or defaulted on any loans.

- Total amounts you owe in credit (30%)-How much you owe in debt and whether you have maxed out your credit cards.

- Your credit history length (15%)- Evaluates if you are new to credit or if you have a long history of borrowing and paying back loans.

- New credit (10%)- How many recent loans have you applied for?

- Credit mix (10%)- Evaluates whether you have a healthy combination of various debt types. That can include a mix of credit cards, mortgage, installment, and retail account loans.

Your overall FICO score considers both the bad and good in your credit report. The percentages we’ve shown in the chart extracted from myfico.comreflect each category’s importancein determining your FICO credit score. However, in some situations, the importance of each category is likely to vary from person to person. What do I mean?

FICO Scores are distinct for every person. The five categories mentioned above serve as the basis for their calculation, but for various individuals, the relative importance of each category may vary. For instance, the credit score calculation for someone who has recently started using credit will differ from those with a more extended credit history.Also, how these factors are evaluated to determine your credit score changes parallel to your credit report.

What is a Good Credit Score?

There are several benefits to having a good credit score. That’s why if you have any issues with your scores, you should definitely consider credit repair Laredo, TXfor your credit repair needs. Credit repair in Laredo, TX, gives you access to better financial packages.

For instance, landlords are more likely to rent their house to someone with a good credit score. Additionally, borrowers with high credit scores tend to pay lower interest rates. That said, here are some of the reasons why you should work towards improving your credit score.

Easier loan approval

One main reason to consider credit repair Laredo, Texas is easier access to loans. Undoubtedly, accessing loans can sometimes be frustrating. What’s even worse, if you have a poor credit score, your chances of accessing loans are significantly reduced.

However, with a better credit score, when you apply for loans, credit cards, and mortgages, you are more likely to be accepted and will spend less time waiting for approval confirmations. Moreover, you can access higher loan limits than someone with bad credit.

Top credit card facilities

You’ll get access to the best credit cards in the market with an excellent credit scores. That means you can access better loan terms such as lower rates and other rewards such as travel facilities, cashback offers, and incentives.

Companies sometimes grant you a 0% APR purchase, popularly known as a balance transfer offer. With time, this translates to significant savings.

Better rates on car insurance

Have you ever tried getting car insurance with bad credit? If you have, I’m sure you know just how frustrating that can get. Most, if not all, insurance companies will take your credit score into account to make a decision, mainly when you apply for coverage.

Insurance companies have the full authority to use your credit score when deciding on your application and how much to charge you. Additionally, they may use this information to raise your premium once you are their customer or even deny you a chance to renew your policy.

With that in mind, better credit scores ensure you have the best rates on your car insurance. So, if you don’t have a good credit score, it’s high time to consider credit repair Laredo, TX for your credit repair needs.

Better negotiating power

Even though you will obviously get lower rates when requesting loans, sometimes you might have to negotiate for it. And that’s where your credit score comes into play. If you need a credit card or loan, having an excellent credit score helps your case.

That means you can take advantage of attractive offers. However, if you have a poor credit score, creditors are less likely to budge on the terms of your loan. In some cases, you won’t actually get the loan. Thankfully, credit repair Laredo, TX, can help you out.

Housing options

We all know that where you live can impact the quality of your life, right? In such instances, good credit can help you secure better options when it comes to housing. Today, we have landlords who check their tenant’s credit scores before renting their houses out to determine if they are trustworthy.

Get utility services more easily

With a good credit score, you will get easy access to set up accounts for utilities such as internet services and electricity. Undoubtedly, getting utility services has much to do with your credit history. That means the better your credit history, the easier it is for you to get these services. Additionally, utility companies might not require a security deposit with good credit.

Easy access to a cell phone

Here’s another reason you should get credit repair in Laredo, TX. Typically, with bad credit, it might be challenging for you to get a cell phone. Yes, you heard that right! Cell phone companies use your credit score to understand whether you are a worthy risk or not.

And if not, you’ll need to deposit some cash, known as a security deposit, before getting access to a cell phone. However, with good credit, you can easily avoid those upfront payments.

Good credit compliments your CV to potential employers

When you apply for a job, some companies might choose to check your credit score as part of your application. In essence, this practical background check is to understand your trustworthiness and whether you should be given the job.

Therefore, most companies might view this as a potential red flag if you have less-than-perfect credit. Most times, it’s advisable to check your credit reports. That will help you spot any mistakes in your credit history, and you can do something about it on time.

So, before applying for any job, ensure that your credit score is perfect. You can always go for credit repair, Laredo, TX, and get professional help on your credit repair. That should help you improve your credit score significantly over time.

Bragging rights

There’s a particular pride that comes from having excellent credit. I’m sure you’ve seen how boastful some of your friends are when it comes to having perfect credit. And that comes from having all these benefits.

Typically, anyone with perfect credit shows that they are enjoying these benefits in their lives. And unfortunately, there’s no shortcut to having excellent credit scores. It takes time and a lot of patience to develop perfect credit, which comes with a certain level of confidence. So, it’s only logical to brag about it.

More importantly, it shows your hard work and the fact that you are an upright citizen. But don’t worry if you have bad credit. The good thing is that you’ve acknowledged it early enough, which means you can do something about it. Take this opportunity to talk to credit repair Laredo, TX and get those scores up. Without a doubt, it’s not something that you can fix overnight. However, one step at a time in the right direction will finally get you there.

Repair Your Credit with Credit Repair Laredo, TX

Repairing your credit is a crucial first step toward regaining financial stability. Good credit helps you gain more control over your finances and protects you from some of the worst financial decisions. If you have tried the steps above but still have difficulty improving your credit, it’s about time you talk to a professional.

Work with a credit repair company like Credit Repair Laredo, TX,to fix and organize your credit report. Our team will assist you in understanding the current state of your credit and offer you reliable suggestions on how to improve it. Working with a credit repair company demonstrates to your lenders that you’re a responsible borrower, and they can rely on you to make payments on time.

We offer customers custom-tailored solutions to help improve their credit scores and set them up for financial success. We are dedicated to ensuring you get your finances back on track and improve your credit rating. On top of that, we have excellent and knowledgeable customer service that has provided credit repair services in Laredo, TX, for years. That guarantees you positive results at the end of this journey.

Remember that fixing your credit can be a long process, and sometimes you might feel challenged to keep going when you feel like things aren’t going your way. That said, contact Credit Repair Laredo, TX, and learn more about how we can help.

How to tell a Credit Repair Scam from a Reputable Credit Repair Company in Laredo, TX

Today, we have thousands of companies that will promise you they can actually repair your credit. Here’s the truth; some of them are scam artists! That’s because they will generally take your money and will not help you. Unfortunately, if you are new to this, the chances of falling for a scam company are higher than finding a reputable credit repair company in Laredo, TX.

These companies promise they can get rid of the negative credit score and even improve your score, but in reality, they won’t do anything for you. Instead, scam companies will likely disappear once they get your money, and you can’t even report them. So, how do you protect yourself from such companies? Or, how can you tell the difference between a reputable credit repair company and a scam one? Well, let’s find out.

Frequently Asked Questions

How long it takes will depend on how many mistakes there are and how good you want the result to be. After making all the appropriate disputes, it takes most people three to six months to fix their credit. If you work on your credit score once a year, it might not take as long.

No one can alter or delete timely and accurate negative information from a credit report. Even if you know how to restore your credit report on your own, it’s advisable to use a credit repair firm if you want the greatest results in the least amount of time.

Due to their credentials and experience, Repair Fast Credit is a company you may trust. We are aware of what to search for and how to have it struck off your credit report.

Incorrect or negative items on your credit report can significantly lower your credit score. Credit Repair Laredo, TX, repairs your credit reports from all three major credit bureaus. This is an essential service as it impacts your ability to get lower interest rates on auto loans and home mortgages. In some cases, credit repair services have even affected the ability of some individuals to get jobs. Although you can try to fix your credit score yourself, it often can be very time-consuming and frustrating. That’s why a professional service will come in handy.

Repair Fast Credit is a licensed company,just as the law requires.

On average, when working with Credit Repair Laredo, TX, it will take about three to six months to repair your credit. Your score will gradually improve throughout the process. However, keep in mind that rebuilding your credit may take years of commitment.

You’ll mostly receive updated information from the bureaus every 2-3 weeks until the credit repair process is complete. Also, they will directly forward to you correspondence on your disputes.

No. Refrain from applying for credit while in the credit repair process as it may interfere with the credit restoration process.

Once you receive your credit reports, send the original copies to credit repair Laredo, TX, for repair. Also, make sure you make copies for your personal records.